Renters Insurance in and around Greensburg

Your renters insurance search is over, Greensburg

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented space or condo, renters insurance can be a good idea to protect your personal items, including your exercise equipment, pots and pans, running shoes, lamps, and more.

Your renters insurance search is over, Greensburg

Rent wisely with insurance from State Farm

Why Renters In Greensburg Choose State Farm

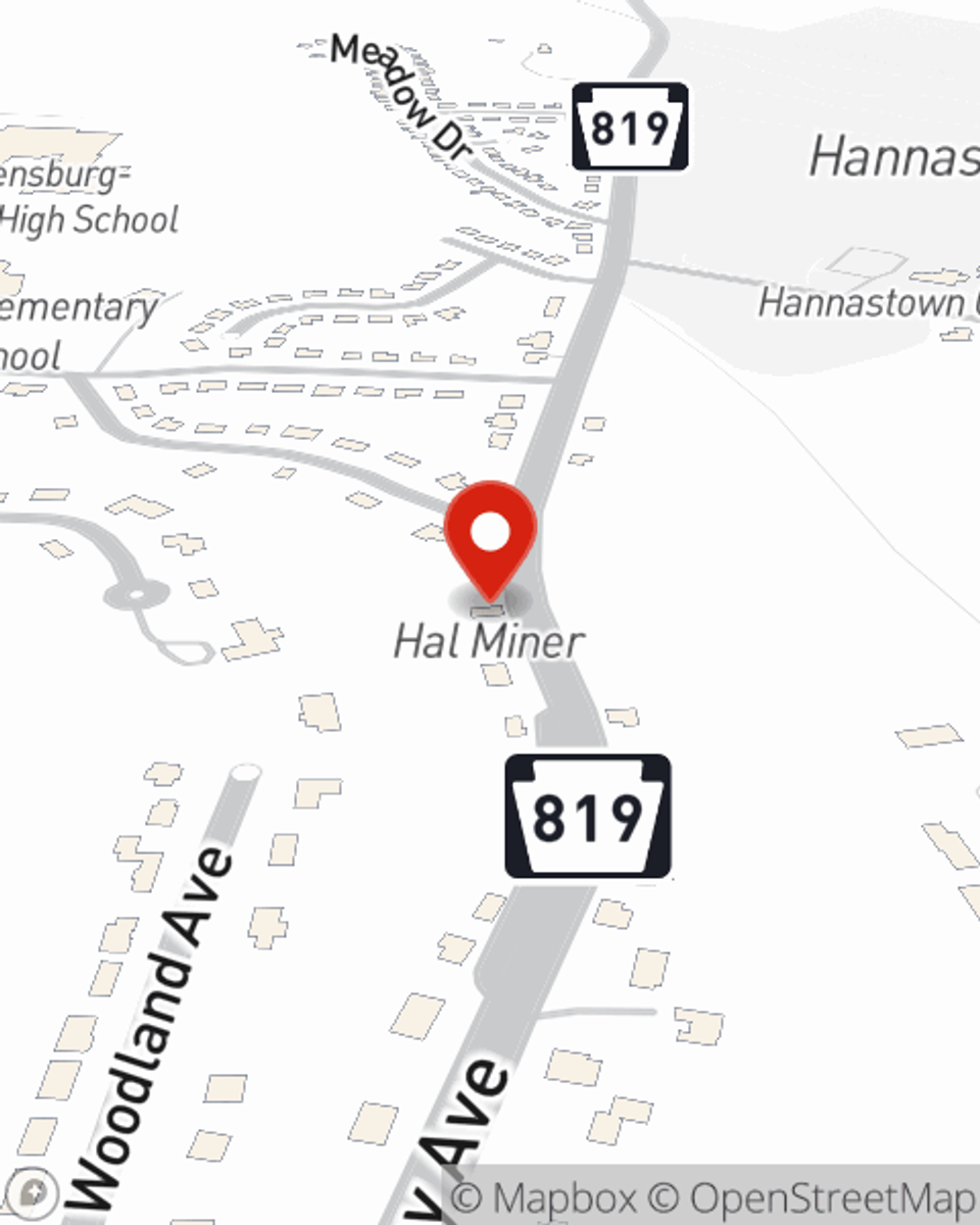

When renting makes the most sense for you, State Farm can help shield what you do own. State Farm agent Matt Cashdollar can help you develop a policy for when the unexpected, like a water leak or an accident, affects your personal belongings.

More renters choose State Farm® for their renters insurance over any other insurer. Greensburg renters, are you ready to discover the benefits of a State Farm renters policy? Contact State Farm Agent Matt Cashdollar today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Matt at (724) 834-3276 or visit our FAQ page.

Simple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Matt Cashdollar

State Farm® Insurance AgentSimple Insights®

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.